Beckham Law Pros and Cons

Highlights and lowlights of the Beckham Law

Glossary

Introduction

The Beckham Law, formally known as the Special Expats Tax Regime (SETR), derived from the Spanish Régimen Especial para Trabajadores Desplazados, introduces a nuanced approach to taxation in comparison to the regular Spanish Personal Income Tax (PIT) or Impuesto sobre la Renta de las Personas Físicas («IRPF»). Join us as we navigate the intricacies of this regime, shedding light on the advantages and disadvantages, with a focus on varying tax rates and the scope of taxable income. In the ensuing sections, we delve into the nuances that shape the Beckham Law, providing a comprehensive understanding of its fiscal implications.

PROS

1. Reduced Income Tax Rate:

One of the main advantages of the Beckham Law is that it allows eligible individuals to be taxed at a flat rate of 24% on their Spanish-source income, regardless of the actual amount.

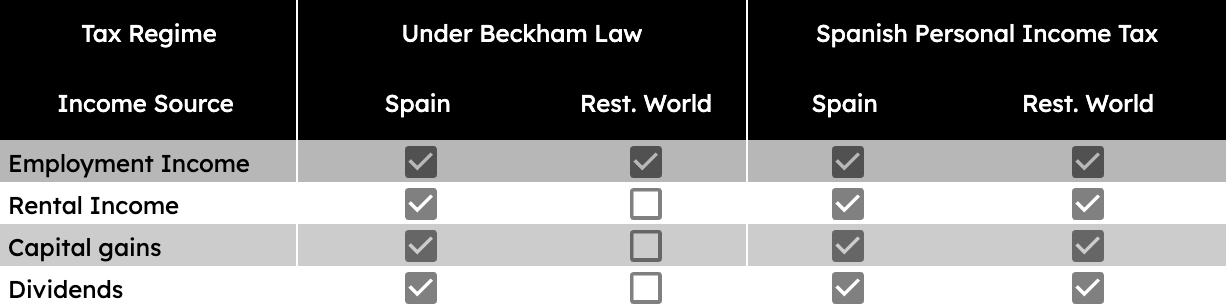

On the positive side, under the beckham law you would not have to pay taxes in Spain over other income generated outside Spain, for example, rental income, dividends, etc. Youw will only have to pay taxes for those types of incomes generated in Spain.

2. Wealth Tax Exemption:

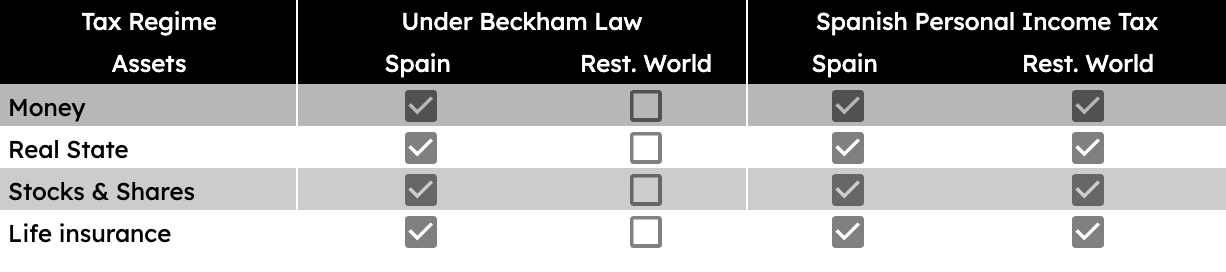

Under the Beckham Law, individuals are exempt from the Spanish Wealth Tax on their worldwide assets for a period of six years.

In various countries, including Spain, the Wealth Tax is levied on the overall value of your assets. Characterized as a progressive tax, its rates escalate in tandem with the extent of one's wealth. In Spain, the Wealth Tax is subject to regional variations, with tax rates potentially reaching up to 3.75%, contingent upon the autonomous community of residence.

3. Simplified Taxation:

The tax process for individuals under the Beckham Law is often simpler, as they are not required to report or pay taxes on their worldwide income, only on their Spanish income, and therefore less processes and couments would need to be filled.

CONS

1. Limited Duration:

The favorable tax treatment under the Beckham Law is applicable for a maximum period of six years. After that period, individuals revert to the standard tax regime, which may result in higher taxes.

2. Exclusion of Foreign Income:

Individuals under the Beckham Law are only taxed on their Spanish-source income. This means that income earned outside of Spain is not subject to Spanish income tax, but it may be subject to taxation in the individual's home country (also known as double taxation).

3. Exclusivity Criteria:

To qualify for the Beckham Law, individuals must meet certain requirements , including not having been a tax resident in Spain for the ten years preceding their new tax residency. This may limit eligibility for some individuals.