How to apply for Beckham Law

Beckham Law Application Step-by-Step Process

Glossary

Introduction

Optimize your tax situation in Spain applying for the Beckham Law following our Spain Tax Calculator step process. Whether you're a professional athlete, entertainer, executive, or skilled professional, understanding how to apply for the Beckham Law is key to enjoying favorable tax treatment. In this guide, we'll walk you through the steps, requirements, form 149 and nuances of the application process. Let's navigate the path to financial advantages together—this is your comprehensive resource on applying for the Beckham Law.

How do I apply for Beckham law in Spain?

Before starting with the procedure, you will need to get a digital certificate to be able to do all the process online. Please read the guide “How to get a digital certificate”.

Once you get the digital certificate, find below the next steps you will need to follow in order to apply for the Beckham law in Spain.

- Download form 030 here.

- Send it to the Spanish Tax Authorities.

- Once received the approval from tax authorities, follow the below steps.

Step 1: How to access to the form for the application:

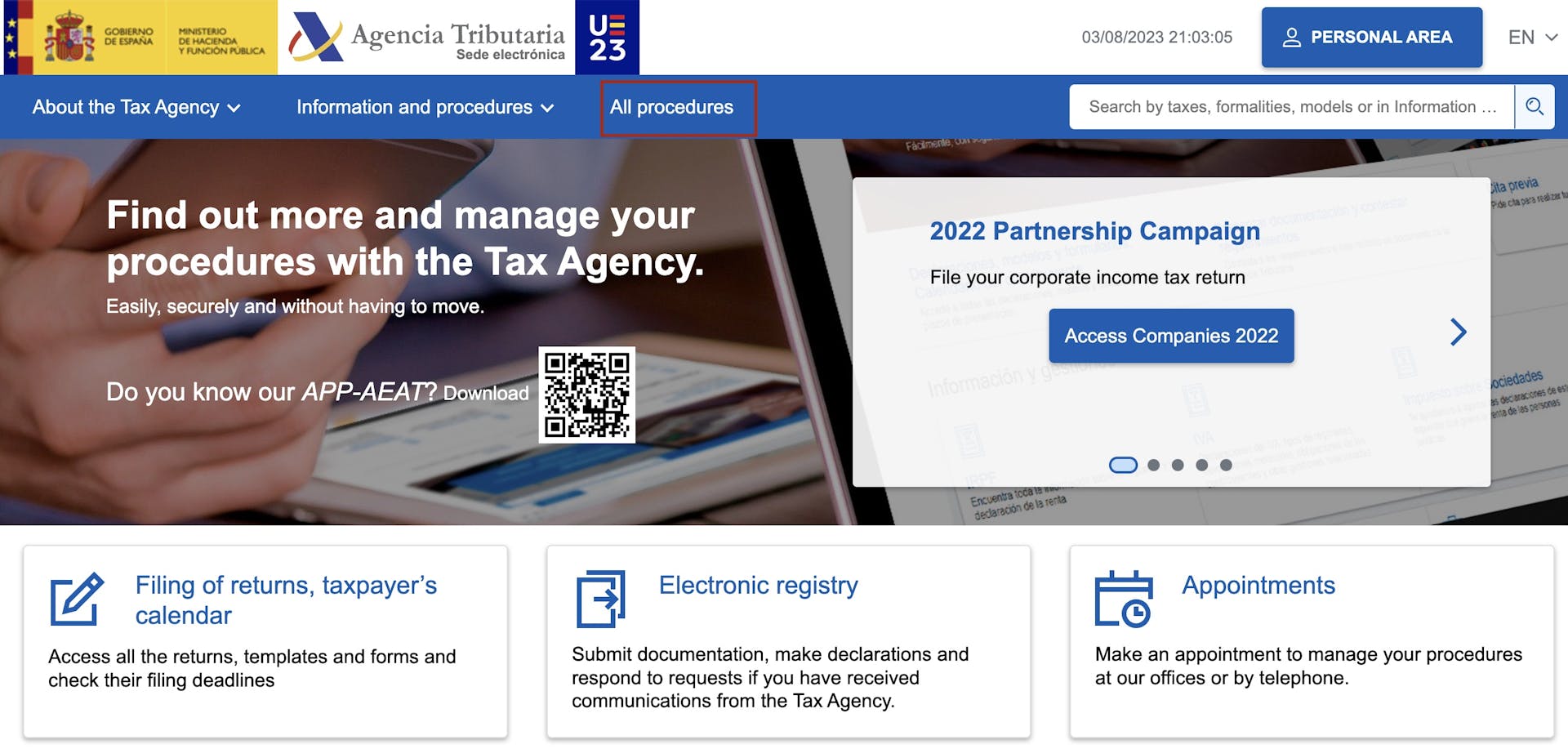

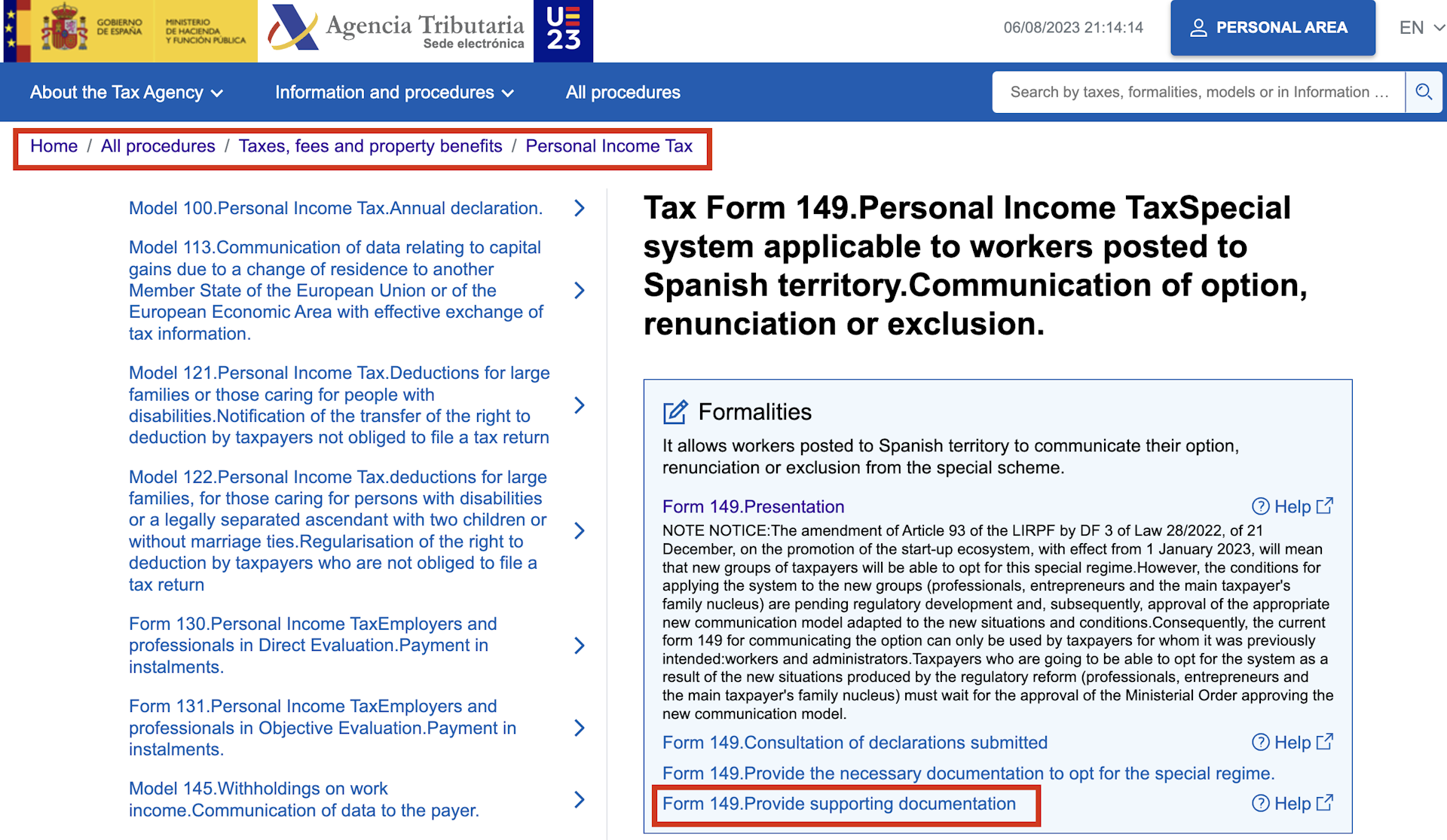

In the Spanish Tax Entity website here select "All procedures", in the main top menu.

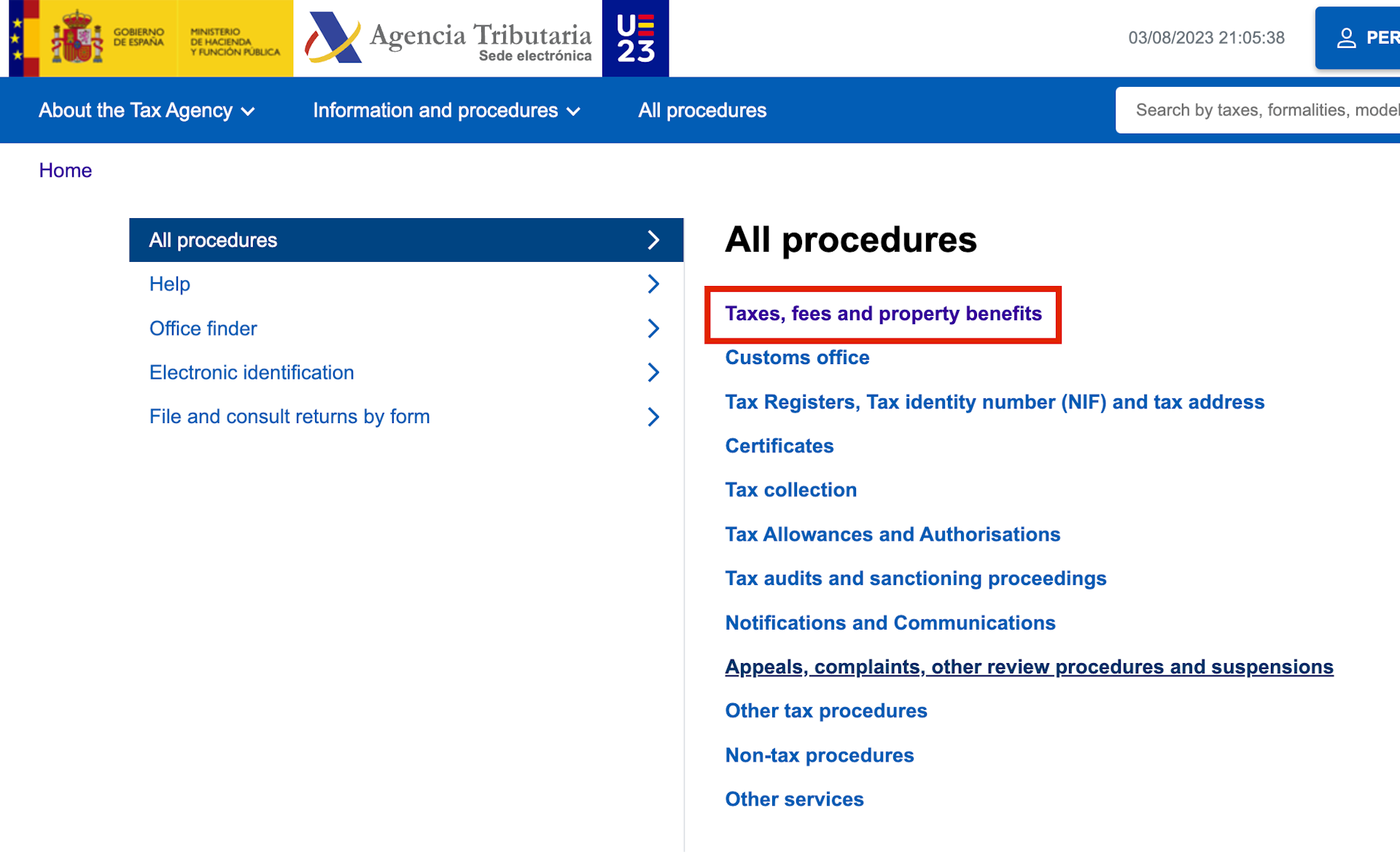

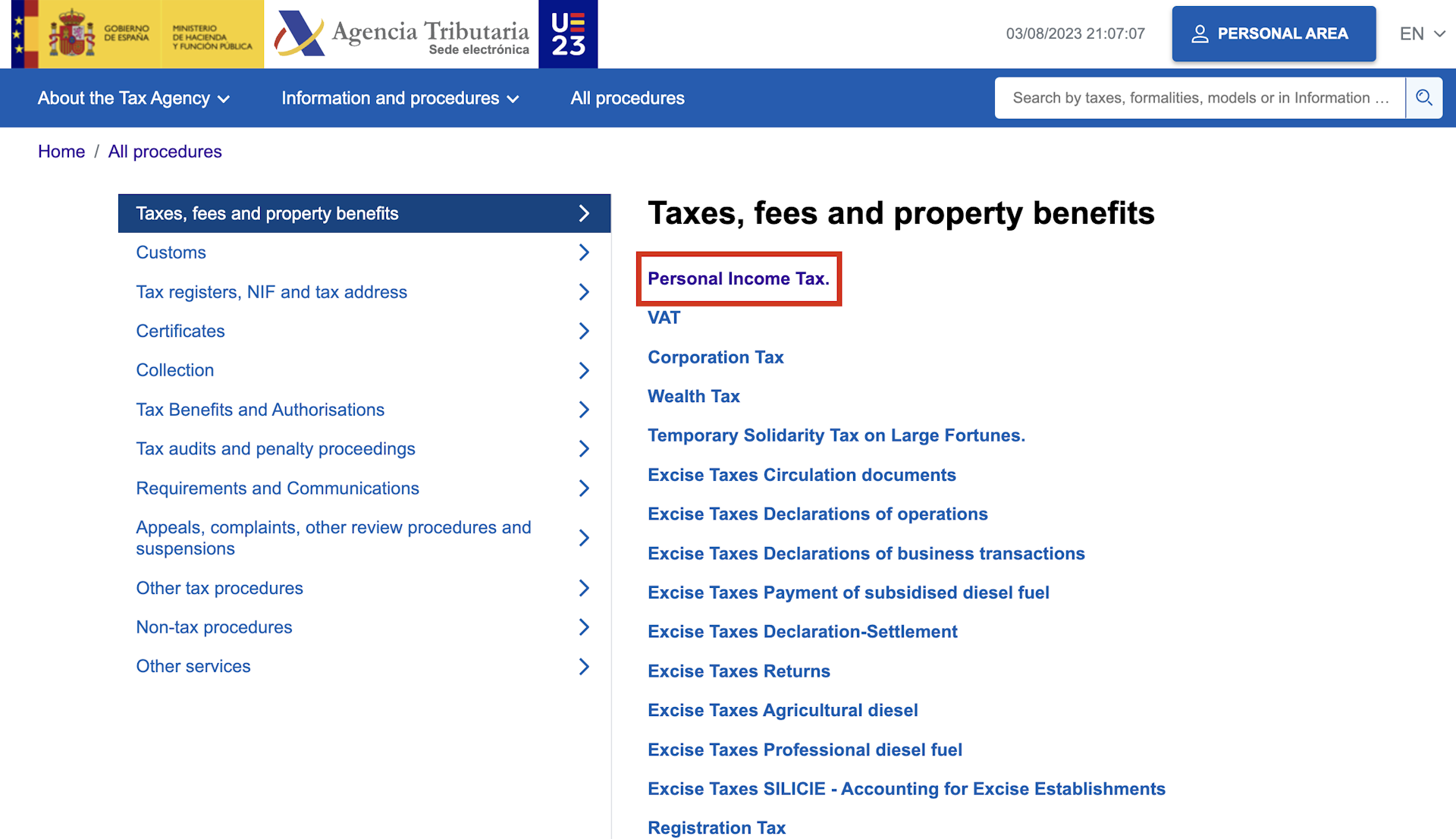

In the following page select "Taxes, feed, and property benefits" and then "Personal Income Tax".

Once in the "Personal Income Tax" page, you will need to find and select the form number 149 (Form 149.Personal Income TaxSpecial system applicable to workers posted to Spanish territory.Communication of option, renunciation or exclusion.)

The next step is to click on "Form 149.Presentation" and then access with the digital/electronic certificate or ID. In the scenario that you have already a Cl@ave Mobile, you can also access via that option.

Step 2: How to fill in the form:

Once you have accessed the form, you must fill in sections 1 and 3.

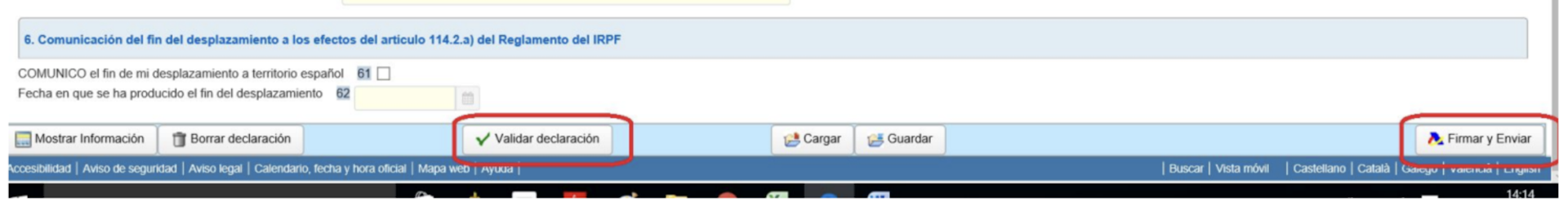

When the form is filled, you have to validate it, sign and send it.

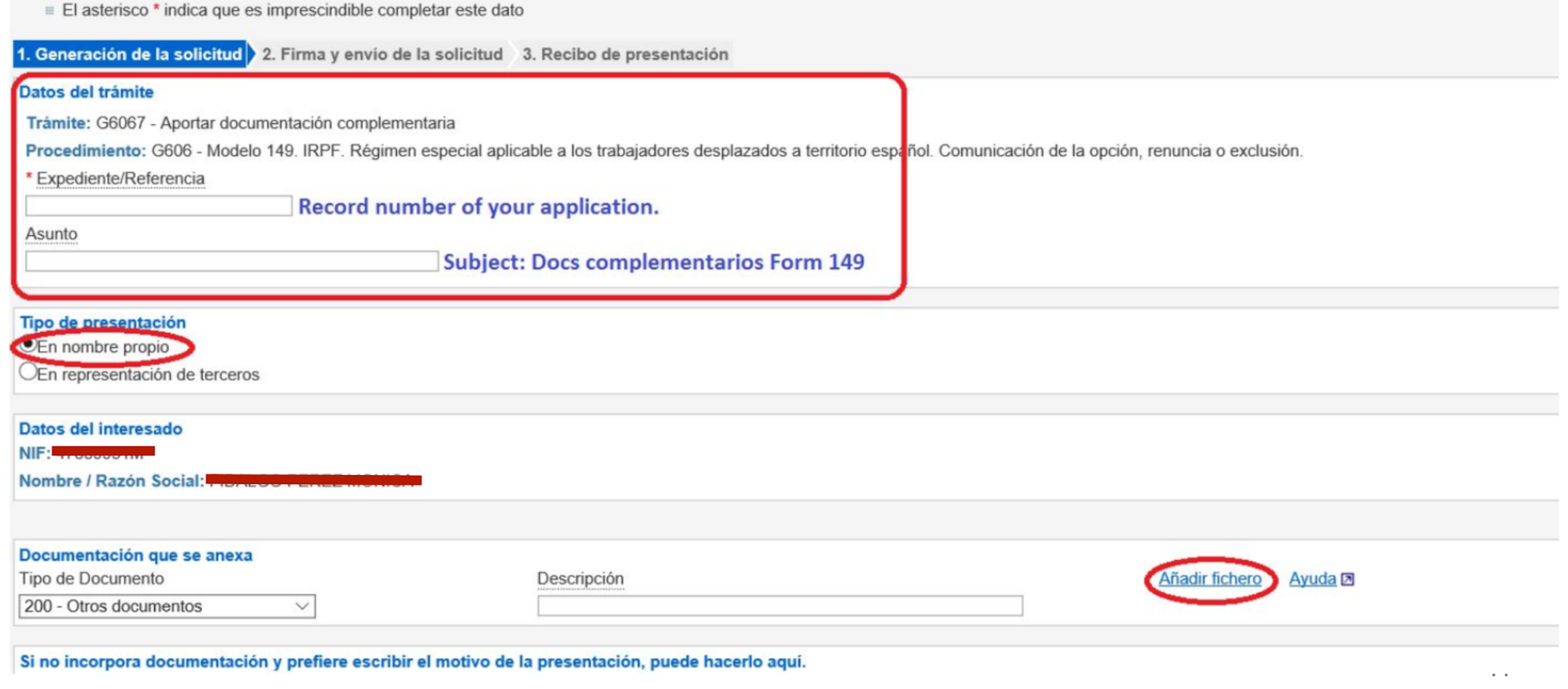

Remeber that you will have to download and save the proof of the application on your laptop. You will need the record number of your application in order to upload the complementary documentation.

Step 3: Complementary documentation:

In this section, you will have to upload the documentation that justifies your employment with your current company/employer. You will need to ask to your new employer the employment certificate and your Social Security registration.

To upload all documents you will need to follow previous path from the home page. "All procedures" --> select "Taxes, feed, and property benefits" --> and then "Personal Income Tax" --> and finally the form 149, landing on this page.

Click on Form 149.Provide supporting documentation to continue the process and upload all documents.

Please, keep as well the proof of the presentation of these documents.

Once you have done all the steps you will receive a letter from the tax office confirming your beckham law application or requesting more documents.

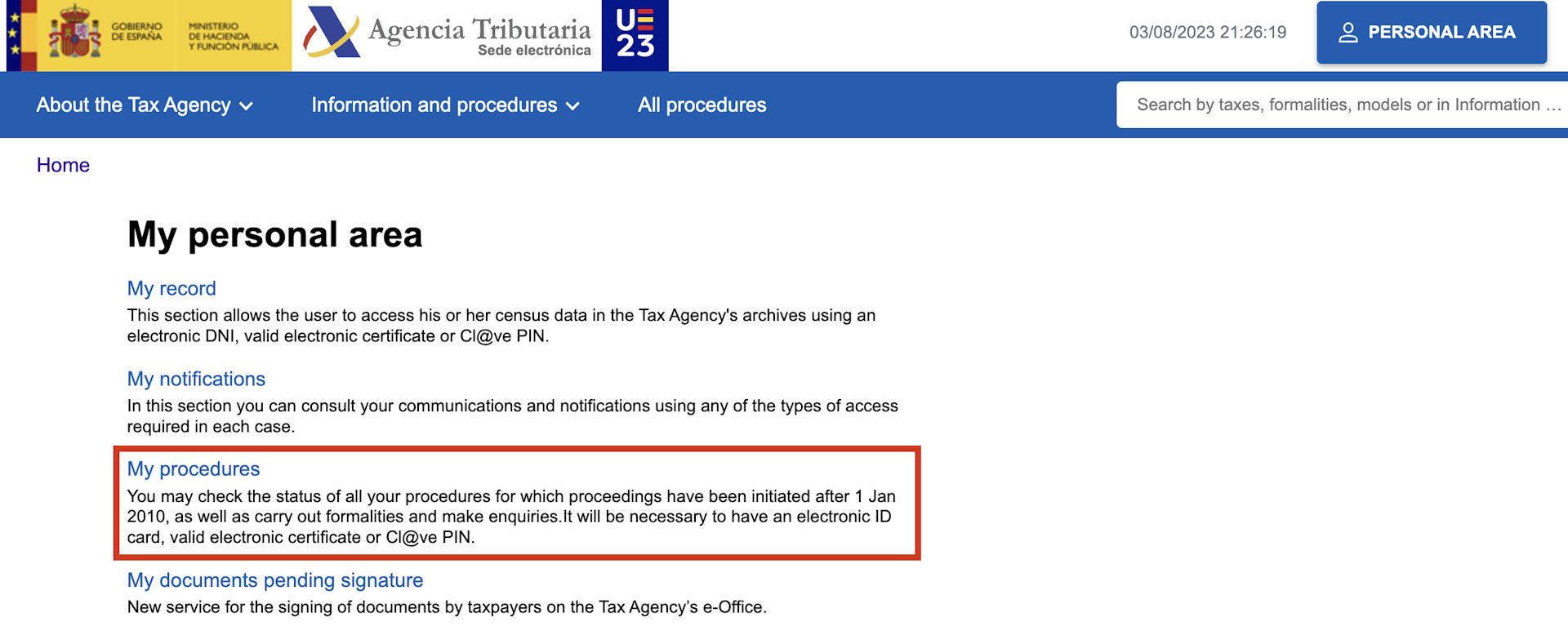

Step 4: How to check the status of your beckham law application:

You can review the status of the procedure from here, selecting personal area, log in, and then clicking on My procedures.

Once you have got the confirmation, normally by post, about your beckham law application, feel free to use our spain tax calculator to get an estimation about your salary with or without the Beckham Law.