What is the Beckham Law in Spain?

A Tax Advantage in Spain

Introduction

Named after the renowned footballer David Beckham, this law offers a unique tax advantage for eligible expats, making it an important consideration for those planning a move to Spain.

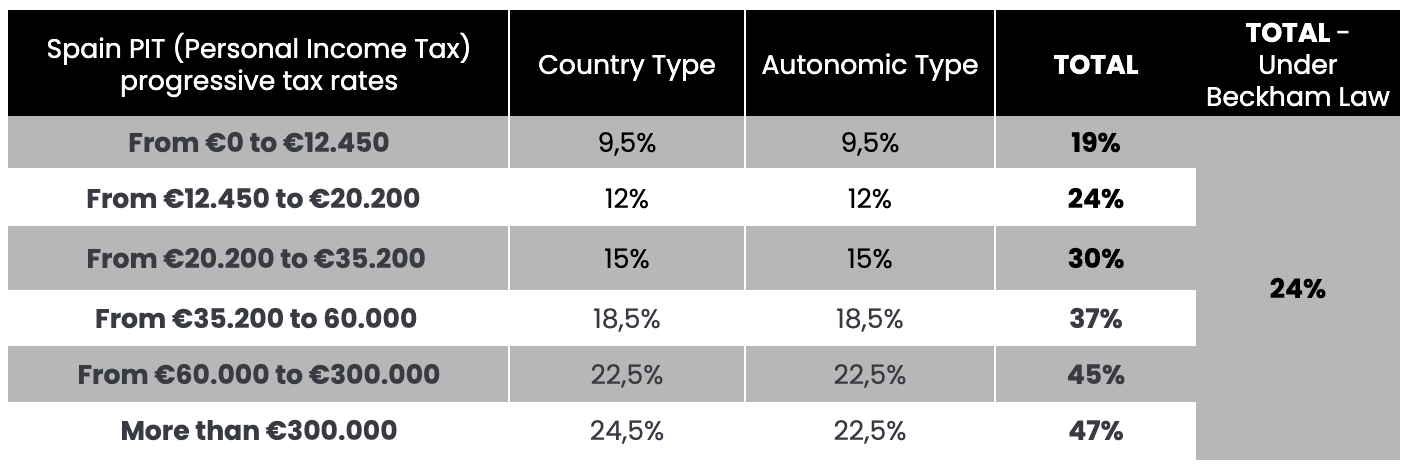

Individuals becoming tax residents in Spain are subjected to the Spanish Personal Income Tax (PIT), known as Impuesto sobre la Renta de las Personas Físicas («IRPF»). In simpler terms, their taxation mirrors that of any other Spanish resident, entailing progressive rates reaching up to 48%, especially for employment income. However, the Beckham Law or Special Expats Tax Regime, comes into play for those relocating to Spain for work and establishing tax residency. This translates to a fixed 24% tax rate on employment income up to 600,000 euros, escalating to 47% for incomes above that amount.

What is the Beckham Law?

The Beckham Law, officially known as the "Impatriates Regime," is a special tax regime in Spain designed to attract skilled professionals and high-net-worth individuals. Enacted in 2005, it allows eligible expatriates to benefit from a flat tax rate on their Spanish-source income, providing a significant reduction compared to the standard progressive tax rates.

Key features:

1. Flat Tax Rate: One of the main attractions of the Beckham Law is the flat tax rate of 24% on Spanish-source income. This rate is notably lower than the standard progressive rates, which can reach up to 45%.

2. Eligibility Criteria: To qualify for the Beckham Law, individuals must meet specific criteria, including not having been a Spanish tax resident in the previous five years prior to their move and obtaining employment or providing services in Spain.

Is primarily designed for expatriates or individuals who haven't been Spanish tax residents for the last five years. It provides a special tax regime for non-residents who move to Spain for employment or to provide services.

3. Applicable Professions: The law is applicable to a range of professions, including executives, professionals, and athletes, making it particularly relevant for skilled individuals considering a move to Spain.

4. National Legislation: The Beckham Law is a national law in Spain, and its core provisions are set at the national level. This includes the eligibility criteria and the flat tax rate of 24% on Spanish-source income for qualifying individuals.

5. Regional Tax Rates: Some autonomous communities in Spain have the authority to set their own income tax rates. While the Beckham Law provides a flat rate at the national level, specific regional tax rates may still apply to certain types of income.

You will find detailed information about the requirements needed to apply for the Beckham Law in our Requirements page.

How to Apply:

Applying for the Beckham Law involves a formal process, including submitting the necessary documentation and meeting eligibility criteria. You will find more information on the How to apply page.

Benefits and Considerations:

1. Tax Savings: The primary benefit is the potential for significant tax savings, especially for those with higher incomes.

2. Limited Duration: It's important to note that the Beckham Law is applicable for a limited duration, typically for the first six years of residency in Spain.

3. Wealth and Succession Planning: Expatriates under the Beckham Law may find it beneficial for wealth and succession planning due to the favorable tax treatment.

Conclusion:

The Beckham Law presents an attractive opportunity for expatriates moving to Spain, offering a reduced tax burden and facilitating a smooth transition. However, navigating tax laws can be complex, and seeking professional advice is strongly recommended to ensure compliance and maximize the benefits of this unique tax regime.

Explore the possibilities, understand the criteria, and consider the Beckham Law as you plan your exciting journey to Spain. You will find more information about it in our Pros and Crons page..

If you would like to know your monthly net salary with or without the beckham law check our calculator.